The world’s longest-ruling coalition could be facing a pivotal moment. Malaysia is set to hold a general election on May 9, 2018 setting up a showdown between Prime Minister Datuk Seri Najib Razak and his political opponents.

The world’s longest-ruling coalition could be facing a pivotal moment. Malaysia is set to hold a general election on May 9, 2018 setting up a showdown between Prime Minister Datuk Seri Najib Razak and his political opponents.

Prime Minister Datuk Seri Najib Razak heads the ruling coalition that has ruled since independence in 1957. Though his administration has faced street protests and corruption scandals since 2015, he has arguably prevailed over one of the toughest periods in his political career, owing to populist elements in the ruling coalition’s manifesto without the substantive economic reforms needed to carry the nation forward.

The ability of the ruling coalition to secure a stronger mandate in the new election—with 222 parliamentary seats at stake—will largely depend on the success of the ruling coalitions’ electoral pledges to strengthen the economy.

Feeling the Pinch

Feeling the Pinch

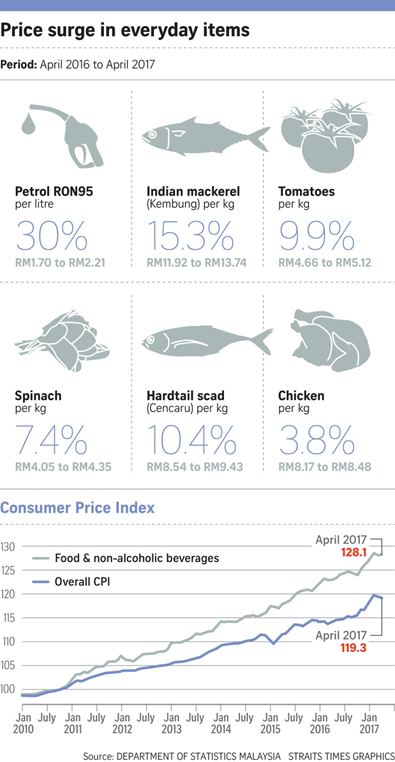

The overarching theme in the ruling coalition’s manifesto in GE13 and GE14 are similar. Both manifestos aimed to reduce the cost of living and increase per capita income through various housing schemes, higher financial aid via the 1Malaysia People’s Aid (BR1M) and an array of freebies for the Federal Land Development Authority (Felda) settlers. While the administration of Prime Minister Datuk Seri Najib Razak regularly boasts of reducing poverty and increasing per capita income, Malaysians are finding it difficult to make ends meet. The ruling coalition which has ruled Southeast Asia’s third biggest economy has seen inflation hit an eight-year high with many blaming the 6 per cent goods and services tax (GST) introduced in 2015 for rising prices, and a weaker ringgit for pushing up the costs of imports. Whether it is a perception problem or not, ministers are acknowledging that this is the key concern for GE14.

International Trade and Industry Minister Mustapa Mohamed, the longest-serving Cabinet member in Prime Minister Datuk Seri Najib Razak’s administration said in a Bloomberg interview recently that the cost of living was the primary concern for voters, “People are worried that the ringgit is not stretching as far as it used to. People remain unhappy about GST,” he said.

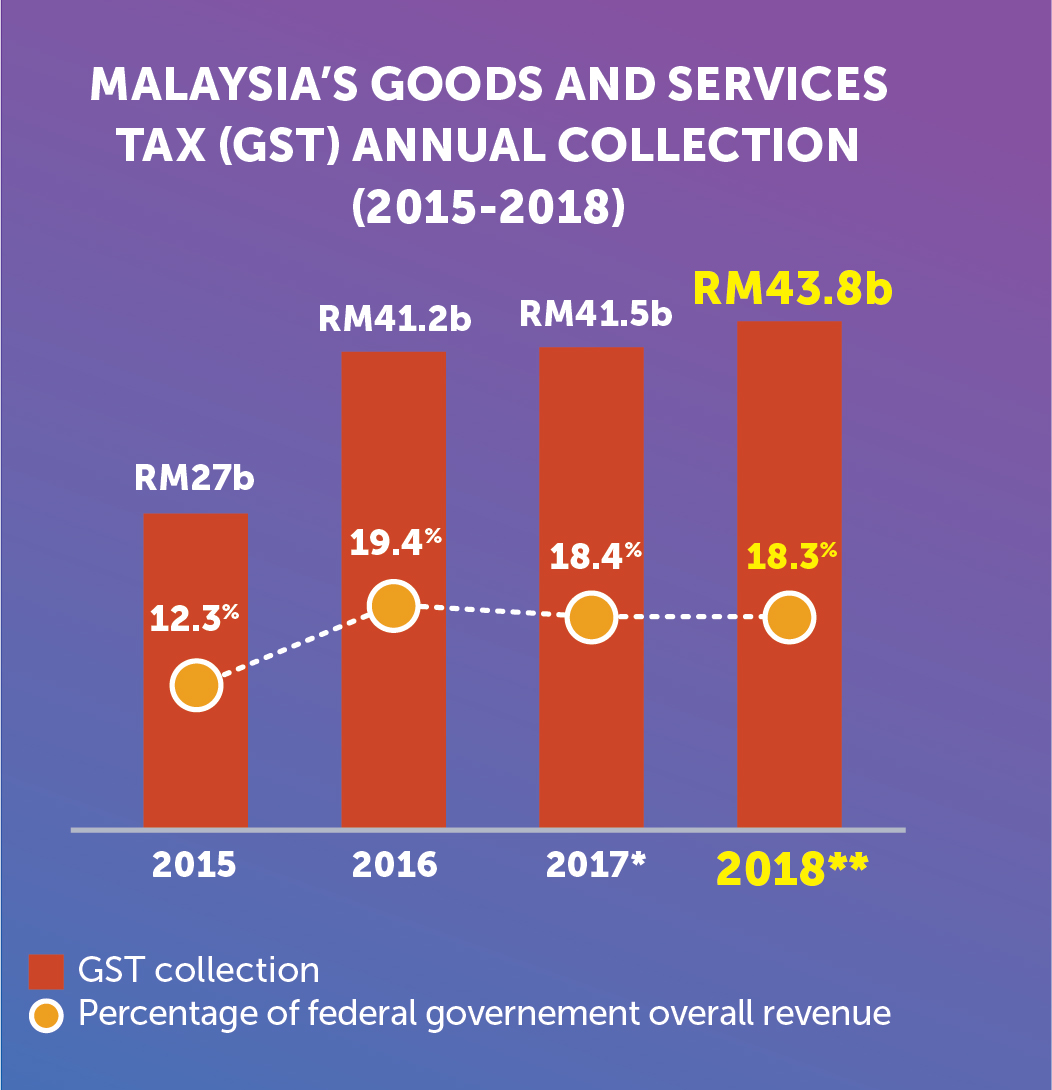

The ruling coalition insists that GST which is expected to contribute RM 43.8 billion or 18.3% of the estimated government revenue in 2018 has helped provide a wider safety net for the lower and middle-income groups through various schemes to help reduce the cost of living. Last year, Prime Minister Datuk Seri Najib Razak boasted that the Economist Intelligence Unit (EIU) ranked Malaysia’s cost of living as the lowest in Southeast Asia. “We have done a lot of work to ease the people’s burden related to the rising cost of living,” said the Prime Minister, listing efforts such as price control, assistance for housing and Felda settlers and, of course, the cash aid scheme 1Malaysia People’s Aid or BR1M.

Beleaguered Ringgit

Since 2012, the Bantuan Rakyat 1 Malaysia (BR1M) scheme was introduced by Prime Minister Datuk Seri Najib Razak as an initiative to provide financial assistance to low income groups (a combined monthly income below RM 4000 for households) in Malaysia. In the ruling coalition’s GE13 manifesto, the ruling coalition promised to gradually increase BR1M payouts to an amount of RM 1200 per household or RM 600 for individuals. In 2017, the payout for BR1M reached a maximum of RM1, 200 for households and RM450 for individuals. In the GE14 manifesto, existing BR1M recipients are to receive RM2, 000 worth of aid this year. To date, almost RM 19 billion of BR1M has been disbursed.

However, the ruling coalition has failed to consider that the other half of the cost of living equation is income. Per capita annual income has dropped from US$10,345 since Prime Minister Datuk Seri Najib Razak’s narrow 2013 election victory to US$8,821 last year – a sharp 15 per cent slide putting an end to most of Malaysia’s middle class aspirations of owning foreign cars and detached houses. Further, the ringgit lost a third of its value against the greenback from 2013 to last year, and is down by 23 per cent against the Singapore dollar in the past four years. A toxic combination of factors has been cited, including sliding oil prices – a key Malaysian export – and a corruption scandal linked to Prime Minister Datuk Seri Najib Razak.

Despite the ruling coalition’s pledge to combat corruption in the run-up to GE13, the ruling coalition’s reluctance to resolve major corruption scandals such as 1MDB for GE14 has affected the Malaysian ringgit and investor confidence. The embattled investment company’s troubles contributed to the ringgit’s biggest annual drop since 1997 last year driving away international companies seeking to set up shop in Malaysia that have long considered corruption to be a business risk. PricewaterhouseCoopers’ Global Economic Crime Survey 2016 saw 30 per cent of respondents saying they faced corruption issues in Malaysia, up from 19 per cent the previous year. While these factors paint a gloomy picture of Malaysia’s economy, the government is unlikely to come down hard on corruption scandals involving 1MDB because it affects the political future of its premier in the run up to the upcoming elections.

GST

The Goods and Services Tax (GST) is one of the most complex tax systems in the world according to the World Bank, and one that requires “Substantial human resources and technology to accurately capture the information,” says Senthuran Elalingam, Deloitte Malaysia’s financial services indirect tax-leader for Asia Pacific. To make matters worse, the structure put in place for payments for Malaysia’s GST is extremely burdensome, requiring payments twelve times a year rather than the international norm of quarterly increasing the tax burden on ordinary citizens despite the exemptions and zero-rated items. The penalties are harsh for failure to comply, including multiple high fines for each payment period and jail time. These many points of engagement with enforcement increase the potential for corruption rather than encourage revenue generation and public cooperation.

The GST was introduced at a time when the ruling coalition was tainted by several expensive and high profile corruption scandals which negatively affected the country’s credibility and revenue position. Concerns have also been raised about public debt. The current ruling coalition has spent and borrowed the most money to shore up political support. While there is a genuine need for more government revenue, public confidence on how it will be spent is low. According to government estimates, the GST made up 16.1% and 19.5% of government revenue between 2015 to 2018.

While government revenue increases, the perception of government and governance are changing. Increasing taxes in Malaysia historically served to provoke rebellion in 1895 in Pahang, 1915 in Kelantan, 1929 in Terengganu and so on. Time will tell whether GST will have a similar response, but the reality is that the GST has become the main policy issue of the ruling coalition’s tenure.

While government revenue increases, the perception of government and governance are changing. Increasing taxes in Malaysia historically served to provoke rebellion in 1895 in Pahang, 1915 in Kelantan, 1929 in Terengganu and so on. Time will tell whether GST will have a similar response, but the reality is that the GST has become the main policy issue of the ruling coalition’s tenure.

Back to Square One

According to Malaysia’s top pollster, Merdeka Centre, Malaysia’s economy will continue to be foremost on the minds of 74 per cent of voters. Inflation will also be relevant for six out of 10 Malaysians, and for more than three-quarters of Muslims, who make up two-thirds of the electorate. As the elections draw near, it seems there is not much for electorates to expect with regards to the ruling coalition’s manifesto in GE14 in terms of substantive economic reforms. “The biggest factor is the worsening economy, which includes rising cost of living, and dwindling opportunities and employment. But as election day draws near, the poor will be showered with goodies, and will be counted on to deliver for BN,” S. Rajaratnam School of International Studies senior fellow Oh Ei Sun told The Straits Times. Before we are counted on to deliver our votes in the coming elections, we should ask ourselves the very question that Ronald Reagan asked during the debate against President Jimmy Carter on October 28, 1980: Are we better off than we were four years ago.