KUALA LUMPUR, Feb 10 — Two businessmen suffered losses totalling RM710,000 over the sale of non-existent Covid-19 self-testing kits in Selangor.

Bukit Aman Commercial Crime Investigation Department (CCID) director Datuk Kamarudin Md Din said they received two reports by the two businessmen in January, and were investigating the crimes under Section 420 of the Penal Code for fraud.

The victims had entered into discussions with parties claiming that they could help in procuring self-test kits from a manufacturer in China. One of them even made payments of RM600,000 for 100,000 self-testing kits, including delivery costs.

“After the payments were made, the kits were never delivered. The victims then inquired with the manufacturer but were told that no such orders were ever placed,” he said at a special media conference here today.

Mohd Kamarudin also advised the public, especially traders, to be always vigilant and conduct due diligence before making payments, especially when it involves big amounts to avoid being cheated.

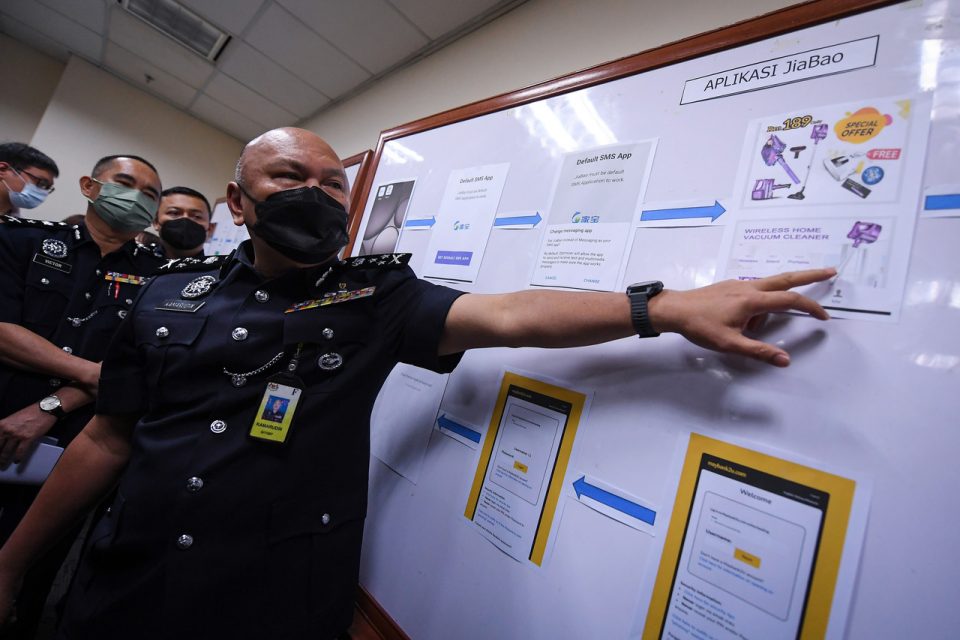

In a separate development, he said police had also detected bank account hacking activities through the download of Android Package Kit (APK) files with five reports lodged so far, three in Johor and one each in Penang and Sabah, with losses of RM58,844.

Investigations revealed that syndicates would advertise products or TV channel services on Facebook, and interested buyers were asked to contact them via WhatsApp. They were then instructed to download and install an app via an APK file link, which would actually replace the existing SMS (short message service) system without their knowledge.

Victims were also instructed to register by providing information including their names, identity card numbers, as well as details of their email, credit card and online banking services, before being given access to use the app, he added.

“After they have provided the information, an error message will appear as the application is not linked to legitimate banking sites. The syndicate’s main purpose is to gain access to the contents of the victim’s SMS texts, as well as banking details, which will be used to transfer money from the victim’s account,” he explained.

The police, he said, were investigating the five cases under Section 420 of the Penal Code for fraud and believed that the mastermind was still in the country. He also reminded the public to not be deceived by ads on social media and not to simply download any APK files.

Those in need of further advice on scams and online fraud can contact the CCID Scam Response Centre at 03-26101559, / 03-26101599, Mohd Kamarudin added.

— Bernama