BANGKOK — Kavita Wongyakasem runs a small business in Bangkok, owns a two-storey house on the outskirts of the Thai capital, drives a pick-up truck, and sends her two daughters to good schools.

But every day is a desperate struggle to find the money to keep her household afloat, said the 48-year-old, whose business provides services for a big energy company.

“I think about it every minute,” said Kavita, breaking into tears as she spoke.

The sole breadwinner of a family of five is about eight million baht (RM1.05 million) in debt and has no cash savings.

“Some days I just cannot face the morning. I d not want to wake up to the reality that we do not have any money.”

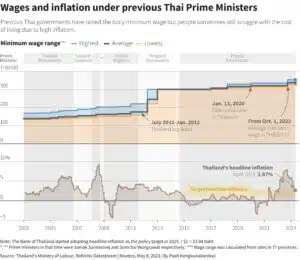

Thailand has among the highest household debt to gross domestic product (GDP) ratios in Asia — behind only South Korea and Hong Kong, according to a Bank for International Settlements ranking – and millions of people, one in every three Thais, are trapped in debt.

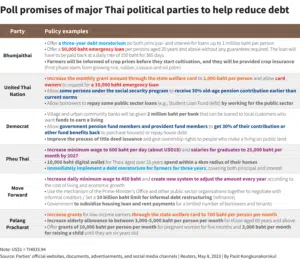

The problem has become a key issue in the May 14 general election, and all major parties have promised wage increases or debt moratoriums, along with guarantee-free loans and handouts.

Pita Limjaroenrat, the prime ministerial candidate of the opposition Move Forward party, which has proposed annual minimum wage revisions, said he would look to fix Thailand’s long-standing inequality problem.

“If you do the maths, it is about one per cent at the top and the 99 per cent at the bottom,” said Pita, who has seen a late surge in popularity.

“Once you are in debt, it is very hard for you to move up the ladder.”

Thailand’s central bank is worried. In February, it said that household debt levels should be brought down from 86.9 per cent of GDP at the end of 2022 to below 80 per cent, to help reduce financial risks.

Political parties’ extravagant election promises could increase the macro-economic risks posed by debt, analysts say.

Excluding overlapping policies, poll promises by nine major parties analysed in February could amount to 3.14 trillion baht (RM41 billion), only slightly less than the annual budget of 3.18 trillion baht (RM42 billion), the Thailand Development Research Institute think-tank estimated.

The election is building up to be another battle between parties aligned with the military-backed establishment and the populist opposition. Whoever wins will have to contend with the gnawing debt problem.

“High household debt rate means that it will not be easy to lay out future policies to stimulate consumption because people are busy paying debts and asking the bank for loans,” said Thanavath Phonvichai, president of the University of the Thai Chamber of Commerce (UTCC).

‘No Warning’

The debt burden starts early for many Thais and can last a lifetime.

Some 58 per cent of people aged 25 to 29 are in debt, and a quarter of people over 60 have outstanding loans, averaging more than 400,000 baht (RM52,710), central bank data shows.

In all, about 30 per cent of those with credit cards or personal loans have a combined debt of 10 to 25 times their income, double that of international standards, according to the bank.

Although a sticky issue for years, the problem has become worse since the Covid-19 pandemic which nearly doubled the number of bad debt accounts to 10 million, according to the central bank.

The pandemic did not ravage Thailand’s 71 million people as much as it did those in some other countries but it hammered the heavily tourism-dependent economy and hit incomes.

“There was no warning,” said Achin Chunglog, president of a nationwide group of volunteers that helps people struggling with debt.

“It was like we were walking and then suddenly a wind came in and swept us off a cliff.”

An April survey of 1,300 respondents with a monthly salary of up to 15,000 baht ($442) by the UTCC found that their debt levels were the highest since 2010.

In the rural hinterland, 90 per cent of farm households have outstanding loans, according to a March study that described a ‘vicious cycle of debt’.

Kavita said her income dropped during the pandemic but expenses rose as she scrambled to keep her staff of about 20 safe from the virus.

To pay salaries and keep her home running, she said she was forced to borrow from outside the banking system.

One recent evening, watching politicians on a televised debate, Kavita said the handouts offered by political parties sounded good but would do little to help those heavily in debt.

“I cannot die,” Kavita said, referring to a law that the assets of a deceased person go to creditors to pay off debts.

“It is an endless struggle.”

— Reuters