KUALA LUMPUR, June 26 — Bank Negara Malaysia (BNM) may take supervisory action or impose penalties for violations of regulatory provisions under its supervision over recent incidents of online banking service outages.

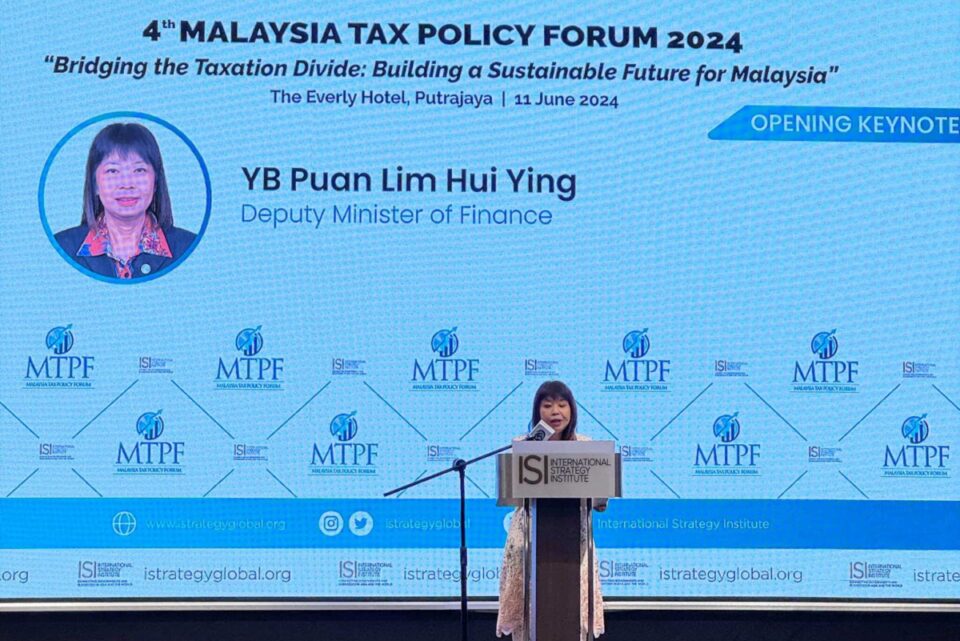

Deputy Finance Minister Lim Hui Ying said the appropriate follow-ups, as provided for under the Financial Services Act 2013 (FSA) and the Islamic Financial Services Act 2013 (IFSA), would depend on an assessment of the cause and impact of the disruptions from the affected institutions.

“Regarding the recent incidents of online services outage, BNM has taken immediate actions to instruct the banking institutions involved to determine the root cause of the disruptions and set appropriate corrective and preventive measures to avoid a recurrence of similar issues.

“In addition, the banks have been instructed to communicate with affected customers, including responding immediately to any complaints and inquiries caused by the disruptions,” she said during a question-and-answer session in the Dewan Rakyat today.

She was replying to a question from Datuk Seri Wee Ka Siong (BN-Ayer Hitam) about the government’s view on frequent online banking service outages, and to what extent the government is prepared to impose penalties following recurring disruptions, to the detriment of consumers.

She said BNM is closely monitoring the situation to ensure the affected banking institutions involved restore their services as soon as possible.

Under the FSA and IFSA, BNM has the authority to impose supervisory and enforcement action against financial institutions non-compliant with provisions of the policy.

This includes the failure to ensure critical systems experiencing unplanned downtime and affecting service access to customers do not exceed the maximum tolerable downtime.

Meanwhile, in reply to Wee’s supplementary question about challenges facing e-payment transactions, Lim said e-payment transactions are immediate, but for holidays and Sundays, they will be floated until the next business day.

— Bernama