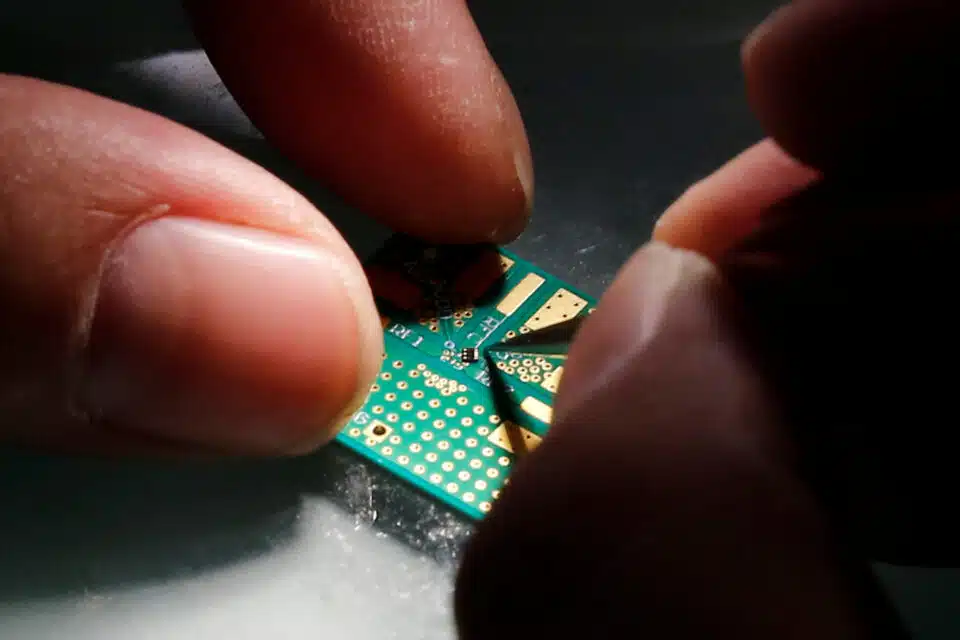

KUALA LUMPUR, Jan 30 — Malaysia’s semiconductor export is set to reap the benefits from higher global demand, said Investment, Trade, and Industry Minister Tengku Datuk Seri Zafrul Aziz.

It sees the benefits coming from the electrical and electronics (E&E) sector, especially from the chips and semiconductor sector, and the nation’s policy on “active neutrality” between the United States (US) and China is very important as Malaysian companies are looking for supply chain resiliency.

“Malaysia has been in this sector for a while now, in the last 50 years, and in terms of global market share of the semiconductor testing sector, we are about 12 to 13 per cent, and we are the sixth largest exporter of semiconductors.

“The E&E sector is so big in Malaysia that 40 per cent of our exports are actually from the E&E sector,” he said in an interview with CNN today.

There have been increased investments into Malaysia and the Southeast Asian region last year against the “tough global economic outlook”.

“In 2022, the total FDI (foreign direct investment ) that flowed into Asean increased 5.0 per cent and if you look at what is happening in the world, the global FDI is down by 12 per cent.

“But, Malaysia’s investments for the first nine months (of 2023) was a record high in the last decade. That shows there is opportunity against the tough backdrop of the global economic outlook,” Tengku Zafrul said.

Malaysia attracted RM225 billion of approved investments in the first nine months of last year, exceeding its full-year target for 2023, with FDI accounting for 55.9 per cent of the total.

He said his ministry (Miti) is looking to diversify trade with other countries and regions while also increasing intra-trade within the Asean region, which currently stands at 20 per cent.

“It is something that we, as trade ministers in the region, are working closely to make sure to increase this number. One of the things that we are looking into is to complete an agreement called the Digital Economic Framework Agreement by 2025 because electronic trade will definitely increase within the region,” Tengku Zafrul said.

He added there is a significant upside of potentials coming from intra-trade within Asean due to its young population aged below 30 years, comprising 50 per cent of the total population of 680 million.

Meanwhile, the government is cautiously optimistic of Malaysia’s gross domestic product (GDP) to be at 4.0 per cent to 5.0 per cent in 2024 and expects the country’s economic growth to be around 4.0 per cent as well.

“There will be some negative impact from what is happening globally and that is why we are a bit conservative with our GDP forecast of around 4.0 per cent to 5.0 per cent. Malaysia is a trading and open economy whereby trade to GDP is 160 per cent.

“We will be watching these (global economic events) closely and we hope the situation will not escalate and have an impact on the region and on Malaysia as well,” Tengku Zafrul said.

On whether the liquidation risk of China’s Evergrande Group could potentially pose a headwind for Malaysia, he stressed the importance of insulating an economy like Malaysia.

“China remains an important trading partner to the Asean region, and to Malaysia as it is the largest, if not the largest to many countries here. And growth in China is going to have an impact on the growth in this region.

“We all know what is happening in the property sector in China and (that may) possibly impact the whole economy of China.

“We will watch it closely but as I said, insulating an economy like Malaysia is important as China and the US (constitute) 45 per cent of the total GDP. So, these two economic powers are going to influence (the economy of) Southeast Asia, especially Malaysia,” Tengku Zafrul said.

Yesterday, Hong Kong ordered the liquidation of property giant China Evergrande Group, a move likely to send ripples through China’s crumbling financial markets as policymakers scramble to contain a deepening crisis.

— Bernama