BY: ERMIZI MUHAMAD

SHAH ALAM, SEP 8: Petaling Jaya residents are advised to update their property assessment tax records before legal action is taken against them.

This can be done by filling-up Borang I which can be downloaded from the Petaling Jaya City Council Website (MBPJ) at www.mbpj.gov.my.

“Failure to do so can result in a fine not exceeding RM2,000 or jail term not exceeding 6 months or both,” MBPJ stated in its official website.

Prior to this, change of property ownership can be performed within three months after the process is successful.

However, the change must be reported for record and filing purposes by MBPJ Property Assessment and Management Department.

The public can contact the department at 03-7954 5984/86/87/89/90 for further information and enquiries.

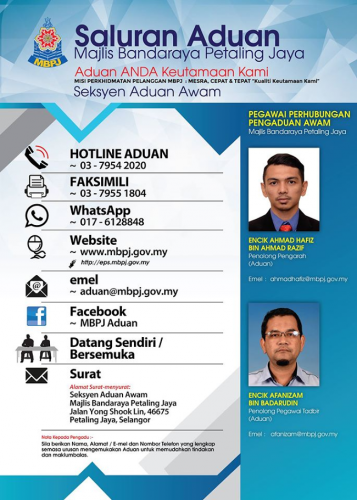

In a different development, MBPJ has now opened a complaint channel for the public through a simpler medium believed to be more effective.

The public can now channel any complaint to the council through its Public Complaints Liaison Officers Ahmad Hafiz Ahmad Razif and Afanizam Badarudin.

Complaints can be lodged by calling hotline number at 03-7954 2020 or via Whatsapp at 017-6128848, as well as email to [email protected].

Complaint letters can also be sent to the MPBJ Public Complaints Section, Jalan Yong Shook Lin, 46675 Petaling Jaya, or handed in directly at MBPJ counters.

Update property tax record to avoid legal action