KUALA LUMPUR, March 9 — Kenanga Research has maintained a “market perform” rating on KESM Industries Bhd after its investment of about RM140 million on new test equipment as car makers shift to expand into the electric vehicles (EV) market.

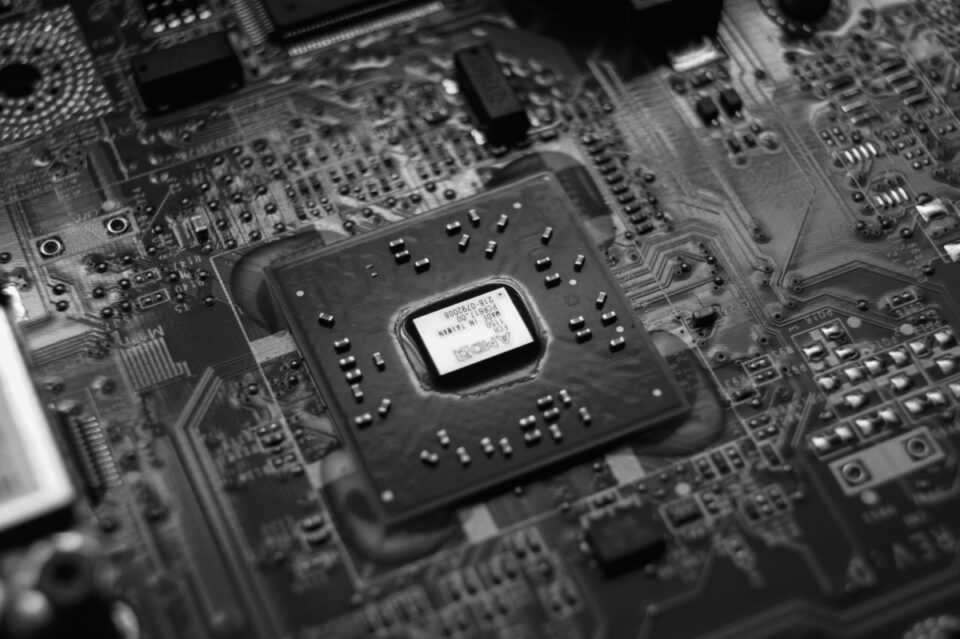

Following the cessation of its Electronics Manufacturing Services (EMS) business and older generation products, KESM is looking forward to transition to new EV-related chips.

The research house likens KESM as a proxy to the promising prospects of automotive semiconductors.

It noted that KESM, being one of the largest independent burn-in and test service providers in Malaysia, could potentially benefit from multinational companies’ expansions in the country. Another positive factor is its physical presence in China to ride on that government’s plans for the semiconductor industry.

“However, we remain cautious in the immediate term as the group still faces a potential risk of sub-optimal loading volume during the transitionary period,” it said.

Kenanga said the group registered a net loss as revenue declined 18.2 per cent due to lower loading volume from the burn-in and test segment, and the cessation of its EMS segment.

Nevertheless, revenue improved 6.1 per cent quarter-on-quarter despite the lockdowns in China.

Hence, the group anticipates a better second half in 2023 (2H 2023) as it transitions into new EV chips.

“The company is anticipating a gradual uptick in loading volume towards the 2H 2023,” it added.

Kenanga Research raised the target price by 25 per cent to RM8.26 from RM7.85 previously.

At 12pm, KESM Industries share price was up five sen to RM7.90 with 5,300 shares traded.

— Bernama