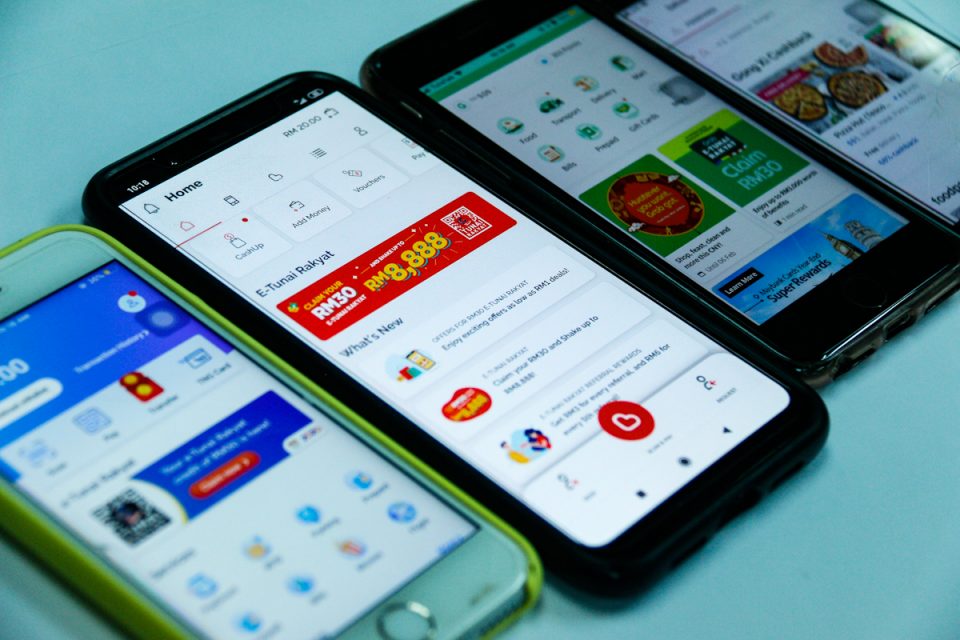

KUALA LUMPUR, Oct 14 — Malaysia has achieved strong growth in using e-payment due to cooperation and commitment from the public and private sectors as well as urban and rural communities, said Bank Negara Malaysia (BNM).

Assistant Governor Abd Rahman Abu Bakar said e-payment transactions grew to 9.5 billion last year compared to 7.2 billion in 2021.

In a statement today, he said on average, each Malaysian made 291 e-payment transactions in 2022 (2021: 222 transactions).

“For example, there were over 100,000 QR code registrations in the first three months of the year, with overall registrations totalling 1.7 million as of the first quarter of 2023.

“I hope this growth can be increased with commitment from the industry to continue helping micro and small traders adapt e-payment into their businesses,” Abd Rahman said when officiating at the eDuit Desa Jom Cashless Programme in Bagan Nakhoda Omar, Selangor.

Concerning the transaction fee on DuitNow QR payments imposed on merchants, he added the industry had taken appropriate steps to reduce the effect on businesses.

For example, major banks and non-bank financial service providers have announced they will continue waiving the transaction fee on micro and small businesses receiving payments via DuitNow QR.

“BNM’s goal, together with financial sector institutions, is to ensure the convenience of e-payment can be enjoyed by all levels of society, whether in urban areas or villages. E-payment is a safe, convenient, and instant payment option,” Abd Rahman said.

The e-Duit campaign, launched last year, will be continued to raise awareness of the benefits of e-payment.

The pilot e-Duit project at Pulau Redang convinced 70 per cent of the island’s businesses to utilise e-payment.

He said this initiative has improved the people’s economy in Redang, where they used to rely on cash transactions.

“Through this pilot project, we have heard from the locals (in Redang) on the positive impact (of e-payment) from the aspects of safety and convenience as well as increasing revenue and economic opportunities through tourism,” Abd Rahman said.

Efforts at the grassroots level, such as this, can generate domestic economic growth and can grow small and medium enterprises to help realise the National Entrepreneurship Policy 2030 and propel Malaysia to become an advanced nation.

— Bernama