PETALING JAYA, Aug 23 — Financial planners and unit trust consultants must increase their understanding and develop capabilities in the area of sustainable and responsible investment (SRI), said Securities Commission Malaysia (SC) chairman Datuk Seri Awang Adek Hussin.

He said investors, especially the younger generation, are becoming increasingly interested in ensuring the capital they deploy is used for good causes, like the transition towards clean energy, which may for example involve investment in a renewable energy SRI fund.

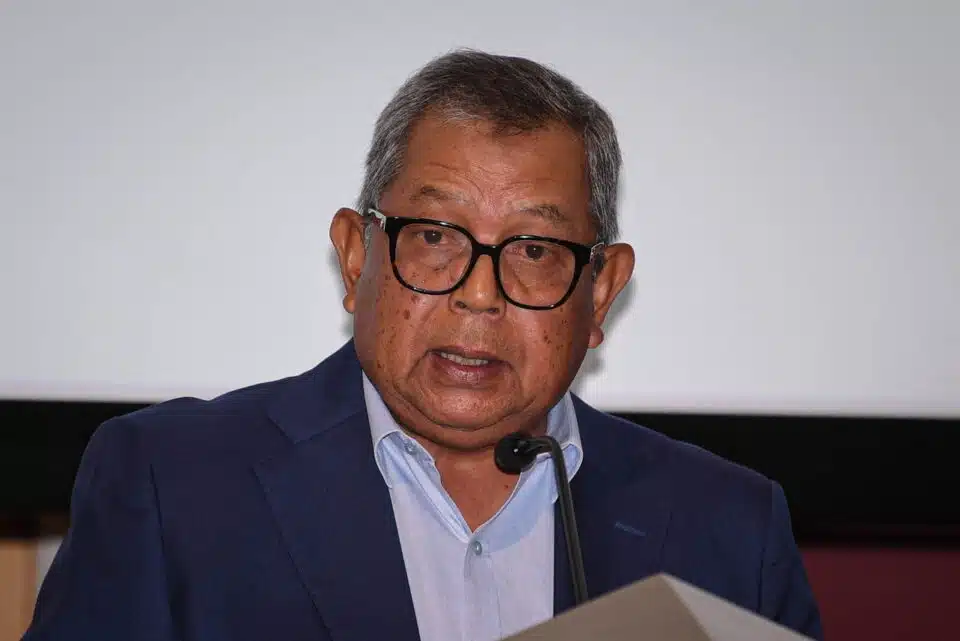

“In this respect, they may rely on the financial planner to guide them on the different types of SRI funds to meet their sustainability goal as well as their other financial goals,” Awang Adek said in his keynote address at the Annual Signature Financial Planning Symposium 2023 organised by the Financial Planning Association of Malaysia (FPAM) earlier today.

Similarly, Muslim investors would also be interested in waqf-featured funds which integrate commercial, social, and religious objectives and allow unit holders to channel all or part of their income distributions received for waqf recipients.

“As such, there is a need to incorporate SRI considerations as a routine component of advice.

“This will ensure that investors are well-informed of the investment options available and the opportunity to align their preference and motivation with their investment goals,” he added.

To ensure that financial planners are equipped with the correct information, the SC will be conducting consultations with industry associations and firms next year to understand challenges in incorporating sustainability considerations and providing guidance to the industry on incorporating sustainability considerations into suitability assessments thereafter.

On the digital tools for the future, Awang Adek said the SC, in partnership with the Capital Market Development Fund, introduced the Digital Innovation Fund (DIGID) in 2022 to enable a new and competitive proposition to the Malaysian capital market.

Through the DIGID fund, the SC envisions all capital market intermediaries, including financial planners, to digitalise services to improve the investor experience and provide greater access to financial planning services.

“Investments into technology have become crucial to sharpen the competitive edge for businesses to deliver the personalised services that investors seek, as well as improve the investor experience and expand these services to a wider range of investors,” he said.

— Bernama