KUALA LUMPUR, March 6 — The National Entrepreneurial Group Economic Fund (Tekun) has approved RM3.34 billion in funding to 206,174 entrepreneurs from 2020 to 2023, the Dewan Rakyat was told today.

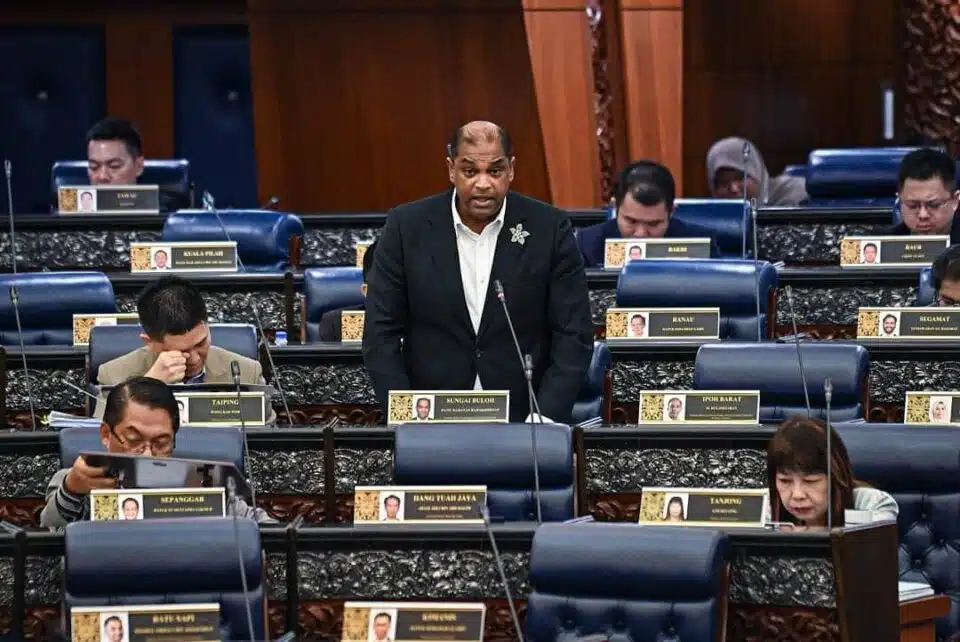

Entrepreneur Development and Cooperatives Deputy Minister Datuk R. Ramanan said the funding approval was made after screening 246,622 applications with a RM5.7 billion funding value received by the agency during the period.

In line with efforts to help micro-entrepreneurs obtain the Tekun financing scheme, the ministry (Kuskop) via Tekun Nasional has reduced the duration of financing approval and disbursement of financing, as well as reducing the need for application documentation.

“Among them, the application documentation requirements are reduced from 17 documents to only four documents, namely a copy of the applicant’s identity card, a copy of the company register or permit, a photo of the business premises, and a copy of the financial statement.

“In addition, the funding approval period was also reduced to seven working days compared to 21 working days while allocation distribution was carried out within three working days,” he said during a question-and-answer session at the Dewan Rakyat.

Ramanan was responding to Sungai Besar MP Datuk Muslimin Yahaya’s query on the statistics of the number of loan applications under Tekun from 2020 to 2023, the number of applications which have been approved, and the loan application’s conditions.

He added that among Tekun Nasional loans’ requirements include being Bumiputera and/or Malaysian citizens (Indian community for the Indian Community Entrepreneur Development Scheme or SPUMI), aged 18 to 65 years for the financing period to expire up to 65 years, and the applicant must not be bankrupt.

Another condition is that the company must be 100 per cent owned by Bumiputera and/or Malaysian citizens (a company 100 per cent owned by the Indian community for SPUMI) and have a specific business location or conduct business online.

Answering an additional question from Sri Gading MP Aminolhuda Hassan regarding Kuskop’s action to collect the debts of borrowers who have not cleared the payment, Ramanan said the government will implement rescheduling of overdue accounts and non-paid financing (NPF).

It will also intensify legal action in addition to offering discounts to borrowers who make lump sum payments.

“Another effort is through collaboration with the Credit Counseling and Management Agency (AKPK) with payments made through AKPK. We will also intensify collection from the (Tekun Nasional) headquarters and branches,” he said.

— Bernama