KUALA LUMPUR, March 5 — The government has been advised to study the implementation of taxes, including the new rate of the service tax, which might have a direct impact on Malaysians.

Bagan MP Lim Guan Eng asked the government to review the new service tax rate and the luxury tax to assess their impact on businesses and consumers.

“If it adds financial burden to businesses and consumers, we can temporarily postpone it due to uncertain economic development. We also know the economy will recover at the end of the year and that the ringgit’s value will rise in the second quarter of the year.

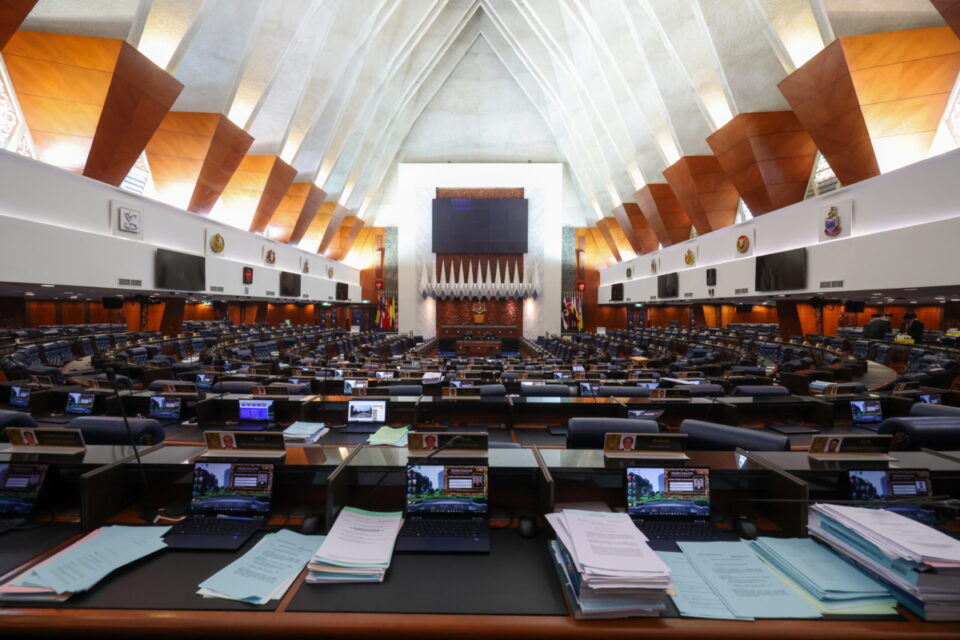

“So I hope the new service tax rate of eight per cent is reconsidered and reviewed,” he said during the debate on the motion of thanks for the royal address at the Dewan Rakyat today.

Kinabatangan MP Datuk Seri Bung Moktar Radin believes it is better for the government to reintroduce the Goods and Services Tax (GST) instead of raising the service tax rate.

“The service tax rate goes up by two per cent, but government collections rise by only RM3 billion, so if we really want to find more money, GST can do the trick, and at the same time implement targeted subsidies as it will help save billions of ringgit for the government,” he said.

Others who raised the tax issue include Keningau MP Datuk Seri Jeffrey Kitingan, Parit MP Muhammad Ismi Mat Taib, and Beruas MP Datuk Ngeh Koo Ham.

The Dewan Rakyat will resume its sitting tomorrow.

— Bernama